Growing a business is both exciting and challenging, especially when it comes to finding the right financing. For many small and medium-sized enterprises (SMEs), securing the funds needed for expansion is essential but not always straightforward. With various financing options available in the UK, from bank loans and government grants to crowdfunding, understanding which option is best suited to your goals can help you unlock new growth opportunities.

This guide will walk you through seven ways to finance your business growth, breaking down the pros and cons of each. Whether you’re looking for traditional loans or innovative funding avenues, there’s something here for every type of business.

1. Bank Loans

Perhaps the most common of the ways to finance your business is via a bank loan. They’re a straightforward way to access capital, often without giving up equity in your business. Bank loans can be ideal for established SMEs with steady revenue. They offer stability but require a solid financial foundation to qualify.

Types of Bank Loans for UK Businesses

- Term Loans: Fixed amounts with set repayment schedules, suitable for purchasing equipment or funding large projects.

- Lines of Credit: Flexible borrowing limits that can be drawn upon as needed, ideal for covering short-term expenses.

- SBA Loans: Loans provided by the British Business Bank or other UK government-backed organisations, designed for SMEs.

Pros:

- Predictability: Fixed interest rates mean predictable monthly payments.

- Ownership: You retain full ownership of your business, as there’s no need to share equity.

Cons:

- Eligibility Criteria: Banks often require strong credit histories, collateral, and detailed financial plans.

- Repayment Pressure: Monthly repayments can be challenging for new or seasonal businesses.

2. Government Grants

Government grants provide funding that doesn’t need to be repaid, making them a highly appealing option for SMEs. Various grants are available to UK businesses, including support for innovation, sustainable practices, and hiring. Government grants can be a great choice for businesses with innovative projects that align with government priorities, but they may not be ideal for companies needing quick or unrestricted cash.

Where to Find Grants

- Innovate UK: Offers grants for research and development, primarily in technology and innovation.

- Local Enterprise Partnerships (LEPs): Regional grants supporting local businesses, often with a focus on economic development.

- UK Government Funding Finder: An online resource for searching available grants based on industry and location (Funding Finder).

Pros:

- No Repayment: Grants don’t require repayment, allowing businesses to invest directly in growth.

- Credibility: Being awarded a grant can enhance a business’s reputation and open doors to additional funding.

Cons:

- Competitive: Grants are highly competitive, with strict eligibility criteria and extensive application processes.

- Limited Flexibility: Often restricted to specific purposes, such as hiring or R&D, which may not align with all business goals.

3. Angel Investors

Angel investors are individuals who invest their personal funds into businesses in exchange for equity. They’re typically interested in early-stage companies with high growth potential, and they often provide valuable mentorship and networking opportunities in addition to funding. Angel investors are a good option for startups and SMEs needing both capital and guidance. Make sure you’re comfortable with the equity and influence you’ll be giving up.

How to Attract Angel Investors

- Networking: Attend business and industry events where angel investors are likely to be present.

- Pitch Decks: Prepare a solid pitch deck highlighting your business’s unique value proposition, growth strategy, and market potential.

Pros:

- Expertise: Angel investors often bring industry knowledge and connections that can be valuable for scaling a business.

- No Repayment Obligation: Unlike loans, there’s no obligation to repay if the business faces financial challenges.

Cons:

- Equity Loss: Giving up equity means you’ll have to share profits and decision-making.

- Investment Expectations: Angels may expect rapid growth, putting pressure on management.

4. Venture Capital (VC)

VC funding is ideal if you are a fast-growing startup looking for ways to finance your business and scale quickly, especially in competitive, innovative markets like technology. Venture capital firms provide funding to high-growth businesses, often in technology or innovative sectors. In exchange for capital, VCs take an equity stake in the business, which they expect to increase in value over time.

Tips for Securing Venture Capital

- Have a Scalable Business Model: VC firms look for businesses with significant growth potential.

- Be Prepared for Scrutiny: VCs conduct in-depth due diligence, so be ready to showcase a solid business plan, revenue model, and growth strategy.

Pros:

- Large Funding Amounts: VCs can offer substantial capital, allowing businesses to scale quickly.

- Industry Connections: Many VC firms offer additional resources, from industry introductions to recruitment support.

Cons:

- Equity Dilution: Like with angel investing, you give up partial ownership.

- High Expectations: VCs often push for aggressive growth, which may not align with every founder’s vision.

5. Crowdfunding

Crowdfunding has become a popular alternative for businesses seeking small investments from a large number of people. Platforms like Crowdcube and Seedrs allow you to raise funds in exchange for equity or rewards, making it possible to gain funding without approaching traditional investors. Crowdfunding is a great option for product-based businesses and startups with a compelling story that appeals to the general public.

Success Factors

- Engaging Campaigns: Craft a compelling story and engage with potential backers on social media.

- Reward-Based vs. Equity-Based: Decide whether you’ll offer rewards (products, discounts) or equity shares to your backers.

Pros:

- Community Engagement: Crowdfunding helps build a loyal customer base early on.

- Funding Without Loans: Raise funds without taking on debt.

Cons:

- Time-Consuming: Preparing and managing a crowdfunding campaign can be time-intensive.

- Not Always Reliable: Crowdfunding success isn’t guaranteed and often depends on market interest and effective promotion.

6. Leasing

Leasing is particularly suitable for businesses that require expensive equipment or technology that needs regular upgrading. Instead of buying assets outright, you lease them and pay monthly instalments, allowing you to conserve cash flow.

Pros:

- Cost Management: Spread out costs over time rather than making large one-time purchases.

- Flexibility: Leases can often be upgraded or changed, ideal for rapidly growing businesses.

Cons:

- Ongoing Costs: Leasing may be more expensive in the long run than purchasing.

- No Ownership: Unlike purchasing, you don’t own the asset at the end of the lease term.

7. Invoice Financing

Invoice financing allows businesses to borrow money against unpaid invoices, offering an immediate cash injection without waiting for clients to pay. It’s particularly popular in industries where extended payment terms are common, such as manufacturing and services. Invoice financing is ideal for businesses with significant outstanding invoices, as it can help bridge short-term cash flow gaps without taking on debt.

Pros:

- Improved Cash Flow: Access funds quickly without waiting for invoice payments.

- Flexible Funding: Only use as much funding as you need, based on current invoices.

Cons:

- Fees: Invoice financing comes with fees, which can impact profit margins.

- Short-Term Solution: Best for temporary cash flow issues rather than long-term growth financing.

Choosing the Right Ways To Finance Your Business

Each financing option has its advantages and disadvantages, and the best choice depends on your business’s growth stage, goals, and risk tolerance. Take the time to assess your needs and consider combining different funding sources to strike the right balance between capital, control, and flexibility.

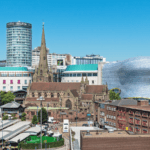

At Grosvenor House, we understand that finding the right financial resources is just one piece of the puzzle. Our virtual office services, co-working spaces, and meeting rooms in Birmingham can provide a cost-effective, professional base for your growing business. Whether you’re pitching to investors or meeting clients, our facilities support your success at every stage.

If you’re ready to take the next step in your business growth journey, consider partnering with Grosvenor House for flexible office solutions that meet your needs. Contact us today via the form below to learn more!